Halloween: An enormous growth oppportunity for books

With Halloween spending growing year to year, opportunities for children’s books to benefit from this seasonal market remain bigger than ever. With the adults in a child’s life taking part in the festive holiday by gift-buying—parents, caregivers, grandparents, and educators—inexpensive book offerings have become a strong and healthy substitute for candy.

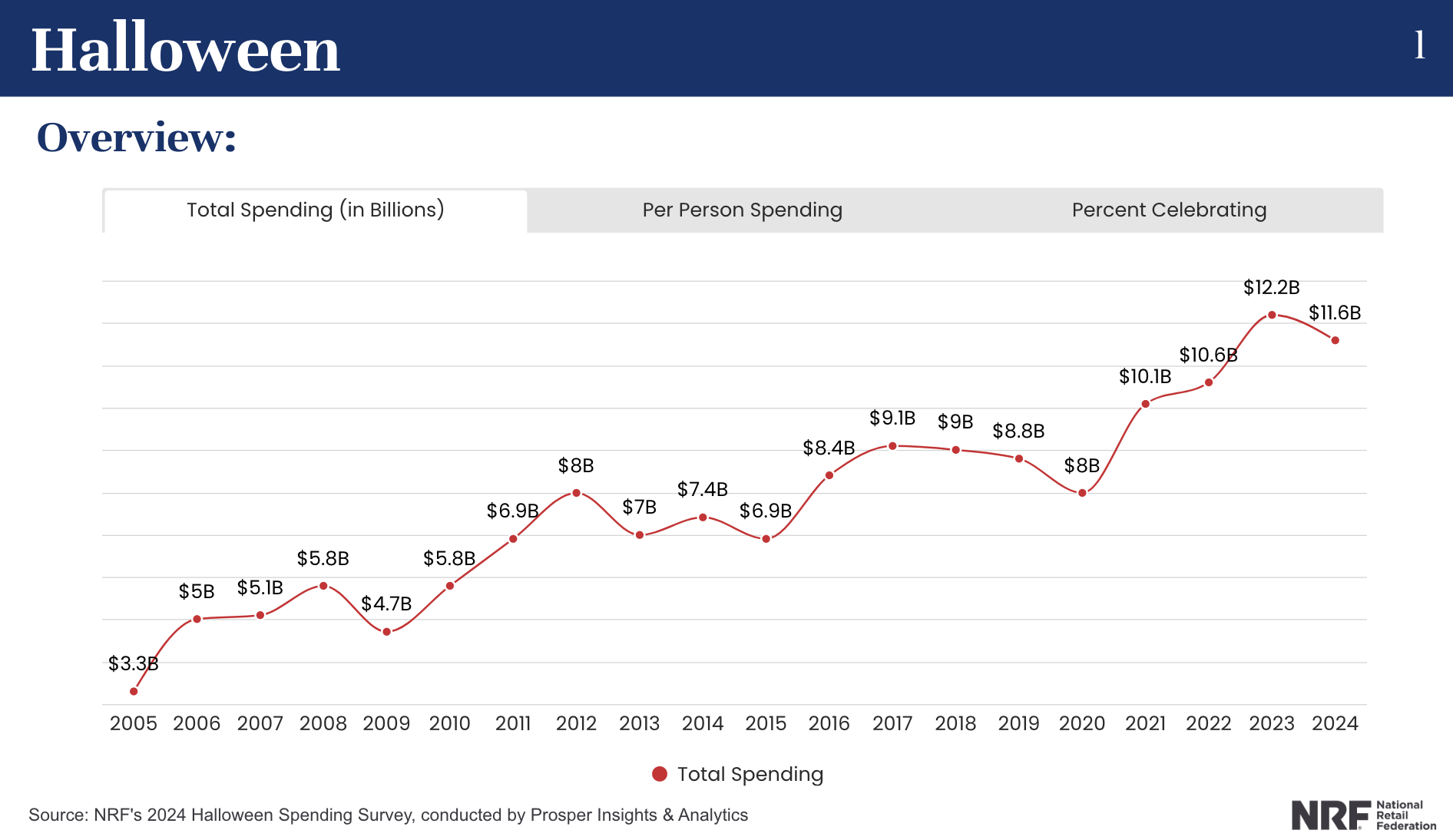

NRF: Halloween Spending Survey 2024, conducted by Prosper Insights an Analytics

Strength of Halloween market in US

Consumers in the United States spent a record $12.2 billion last year on Halloween. This makes it one of the highest retail spending events of the year. This year, that number decreased slightly.

Consumer stats for Halloween

With about three out of four consumers in the United States celebrating Halloween, that is a huge consumer base to tap into for children’s Halloween book buys, to substitute or add to candy-giving. On average, U.S. shoppers spend approximately $103.63 per person on Halloween-related products.

Timing is everything

Most of the Halloween shopping, whether costumes, decor, greeting cards, or candy, was done before October, making early shopping key to less stress purchasing. This means products, including books, must be out as early as August. Yet last-minute shopping was also prevalent, with sales of Halloween-themed books increasing by more than 65% in the two weeks leading up to the second week of October.

Where consumers were buying

Warehouse clubs are a big part of the spending market for Halloween buys, but impulse buying for gifts rather than candy are important as well, making discount stores, independent bookstores, and party stores, convenient for last-minute purchases. Giant online retailers drove 47% of Halloween sales.

Source: NRF’s 2024 Halloween Spending Survey, conducted by Prosper Insights & Analytics

Bottom line

Halloween continues to be an upward-trending marketing for U.S. consumers, with early availability being key, and opportunities for new book titles continuing to rise.

Sources: National Retail Federation, WebInterpret, The Bookseller